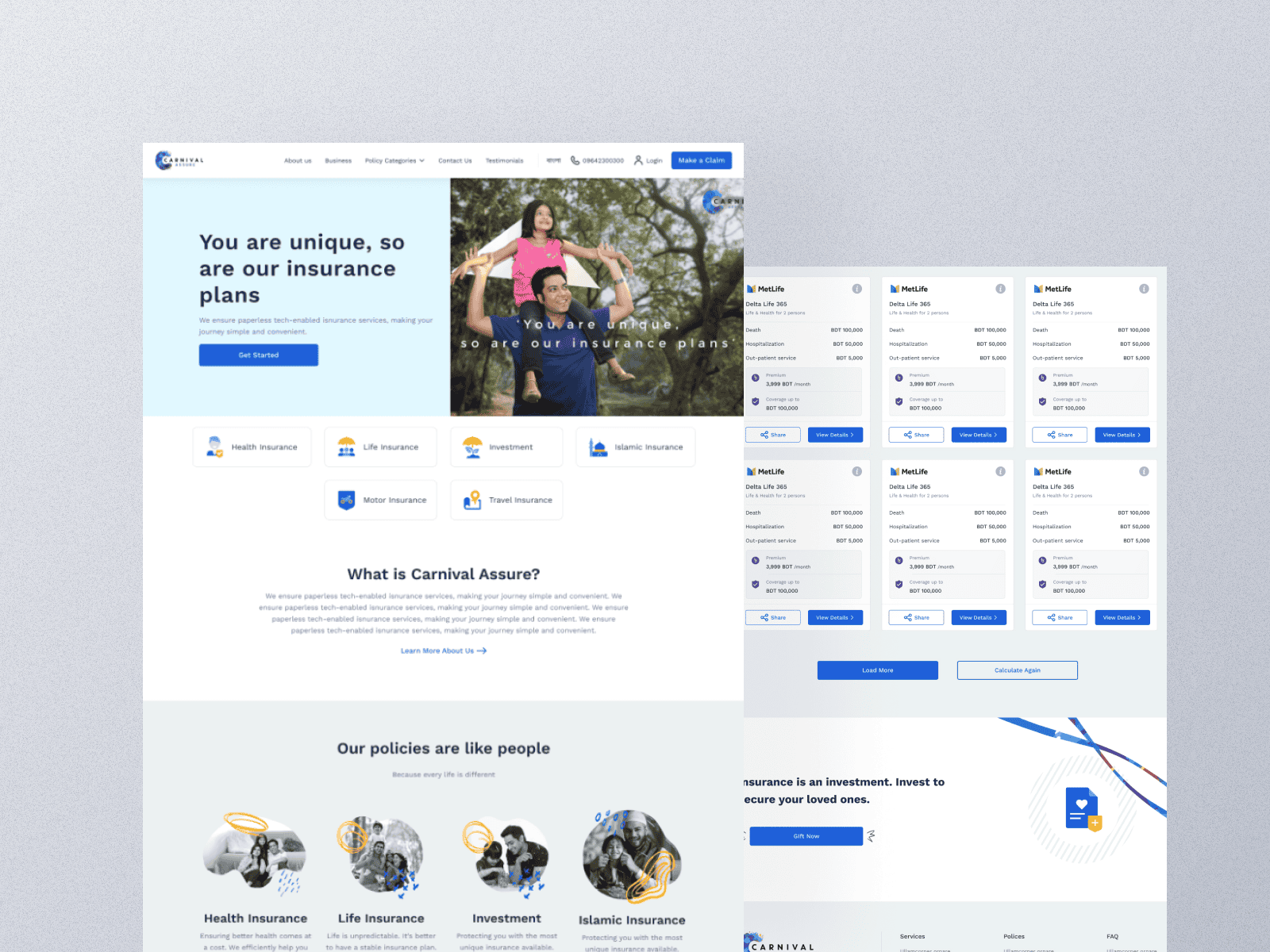

Carnival Assure – Insurance Made Simple

Bangladesh’s first digital insurance platform that turns confusing paperwork into intuitive experiences.

Carnival Assure is a comprehensive insurance aggregator offering everything from life and health to auto and travel insurance. My challenge?

Make one of the most traditionally complex industries feel as simple as online shopping.

- Platform: Web Platform & Responsive App

- Project: Complete UX/UI redesign, design system creation, user journey optimization

- Goal: Transform intimidating insurance processes into user-friendly digital experiences

- Results: 40%+ EMI adoption growth, major reduction in claim drop-offs, highest user engagement on comparison features

Role & Responsibilities

Head of UX/UI leading this project since 2017. I’ve been the design brain behind every major iteration, working with everything from user research to front-end implementation.

What kept me busy:

Leading UX/UI strategy, directing design teams, creating wireframes and design systems, running user tests, and collaborating closely with developers and business teams. Also optimized for slow networks—because not everyone has fiber internet.

The Real Challenge

Insurance in Bangladesh? Intimidating, paperwork-heavy, and confusing. Users would start the process, get overwhelmed, and abandon their applications. Claims felt like navigating a maze blindfolded.

The biggest pain points:

- People didn’t understand what coverage they actually needed

- Claim filing felt scary and unclear

- EMI options existed but nobody used them

- Rural users struggled with slow connections

How I Solved It

1. Research That Actually Mattered

I dug deep into user behavior, talked to real people (not just personas), and identified where people got stuck. Turns out, jargon was the enemy and guidance was missing everywhere.

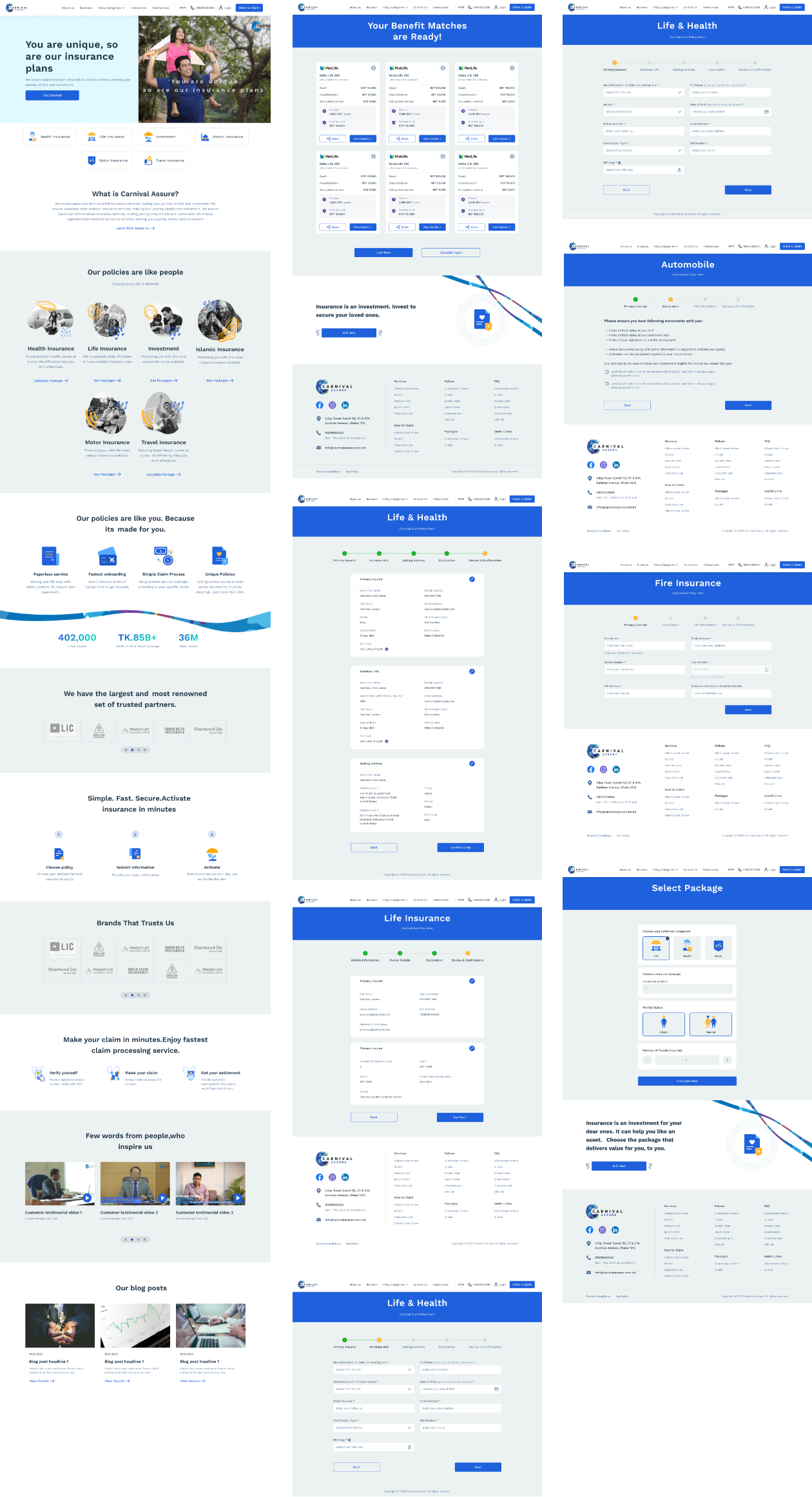

2. Simplified Key Journeys

Policy Purchase: Turned a 20-step nightmare into a guided, visual experience where users can compare, customize, and buy without confusion.

Claims Process: Redesigned from a maze into 3 clear steps with visual progress tracking and upfront document requirements.

EMI Calculator: Created an instant preview tool so users see exactly what they’ll pay monthly before committing.

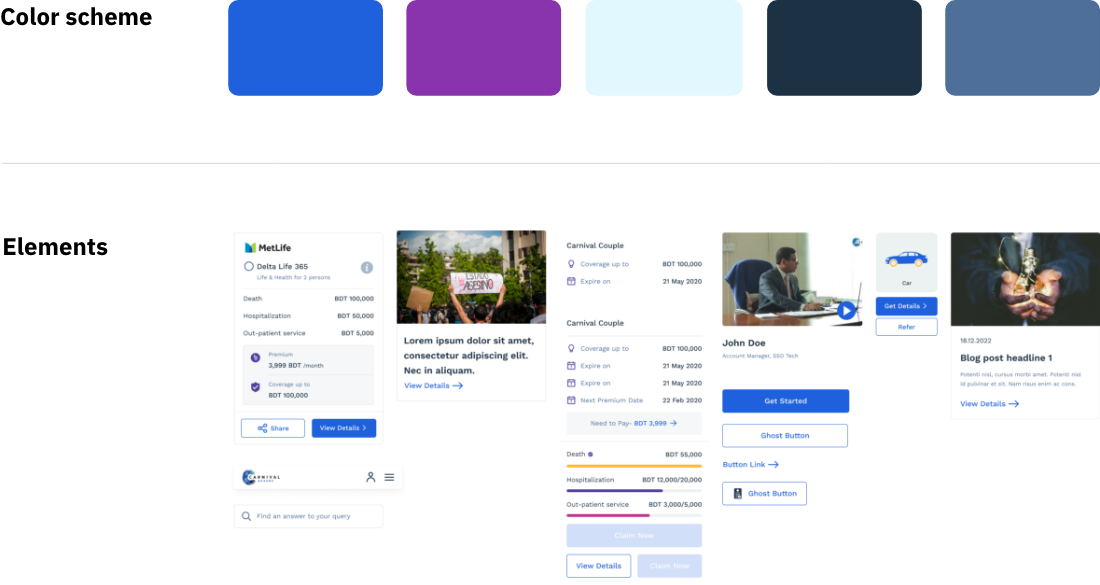

3. Design System That Scales

Built a modular system that works across all insurance types:

- Reusable components for forms, progress indicators, and summaries

- Color-coded categories (life, auto, health) for instant recognition

- Mobile-first design that works on slow networks

The Visual Approach

Created a clean, trustworthy interface that doesn’t intimidate users. Used simple language, helpful tooltips, and step-by-step guidance throughout. Every component was designed to scale-supporting new insurance products without starting from scratch.

Key design decisions:

- Replaced insurance jargon with plain English

- Added visual progress indicators for multi-step processes

- Included real-time previews for EMI calculations

- Made document uploads simple with drag-and-drop

What Users Get Now

Dashboard Experience: A personal insurance command center where users can see all policies, track claims, manage EMI payments, and purchase additional coverage.

Smart Comparisons: Side-by-side plan comparisons that highlight what actually matters to each user.

Transparent Claims: Users know exactly where their claim stands with real-time updates and clear next steps.

The Impact

Since launching the redesigned experience:

- 40%+ increase in EMI adoption (people actually use it now!)

- Massive reduction in claim abandonment rates

- Highest engagement on comparison pages post-redesign

- Continuous scaling with new insurance products added seamlessly

The platform has become the go-to insurance solution in Bangladesh, proving that good design can make even the most complex industries accessible to everyone.

What's Next

The success of the current platform has led to an exciting evolution. I’m currently designing Version 2.0 with a completely refreshed UI, enhanced user experience, and powerful new features that will further simplify insurance for Bangladeshi users.